-

Welcome to Tundras.com!

You are currently viewing as a guest! To get full-access, you need to register for a FREE account.

As a registered member, you’ll be able to:- Participate in all Tundra discussion topics

- Transfer over your build thread from a different forum to this one

- Communicate privately with other Tundra owners from around the world

- Post your own photos in our Members Gallery

- Access all special features of the site

Will the new hybrid Tundra qualify for the $7500 tax credit?

Discussion in 'General Tundra Discussion' started by bigdans, Aug 11, 2022.

Summer Mods/Flapping Seatbelts

Summer Mods/Flapping Seatbelts How to put patches on the headliner?

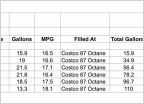

How to put patches on the headliner? Another Useless MPG Thread....

Another Useless MPG Thread.... DIY: Installing Lockable Fuel Door "CHROME"

DIY: Installing Lockable Fuel Door "CHROME" Dash Cams

Dash Cams Lost Key Fob for my 2020

Lost Key Fob for my 2020