-

Welcome to Tundras.com!

You are currently viewing as a guest! To get full-access, you need to register for a FREE account.

As a registered member, you’ll be able to:- Participate in all Tundra discussion topics

- Transfer over your build thread from a different forum to this one

- Communicate privately with other Tundra owners from around the world

- Post your own photos in our Members Gallery

- Access all special features of the site

Lease new 1794? Or wait and buy new Limited?

Discussion in '2.5 Gen Tundras (2014-2021)' started by Jaybird79, Mar 18, 2019.

Page 1 of 3

Page 1 of 3

Black step bars that DON'T rust.

Black step bars that DON'T rust. Tailgate wing?

Tailgate wing? Dashcam wiring help

Dashcam wiring help Attaching strut to the bolt head

Attaching strut to the bolt head Brake light LED?

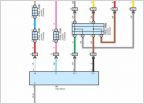

Brake light LED? Adding Fog Lights on Tundras without them

Adding Fog Lights on Tundras without them